Big Cases by the Numbers [December 30, 2024]

This first edition highlights several important cases litigated by some of the biggest national firms over the last month

While quantifying case importance is a subjective art at best, there are some measurable elements that provide deeper than a gut impression as a basis for comparison. Some possibilities include dollar value or companies involved, case complexity, differences of opinion between judges, firms involved in litigating the cases, and interests or implications for those beyond the immediate parties to the matter.

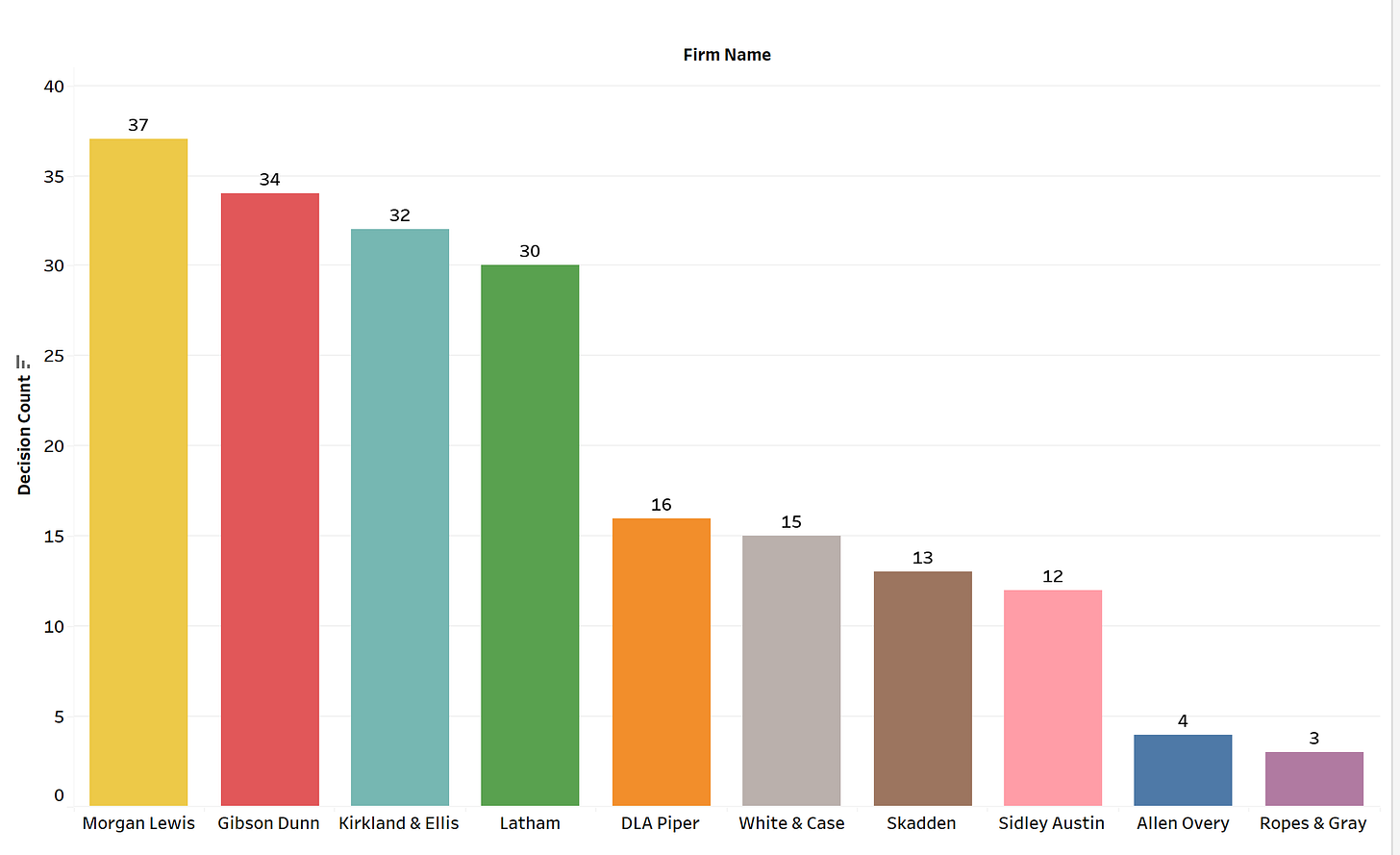

With these layers in mind, I started out by examining opinions where the following firms which are currently around the top revenue generators in U.S. law were counsel: Gibson Dunn, Skadden, Latham, Morgan Lewis, White & Case, Ropes & Gray, Allen Overy, Kirkland & Ellis, DLA Piper, and Sidley Austin.

The sample of written opinions with at least 100 words (a way to attempt to exclude summary decisions) based on these parameters was 136.

Here are a few ways to break down the numbers. First based on law firm

There is quite a range from 37 to three decisions and large drops from the first four firms to the next four and finally to the last two.

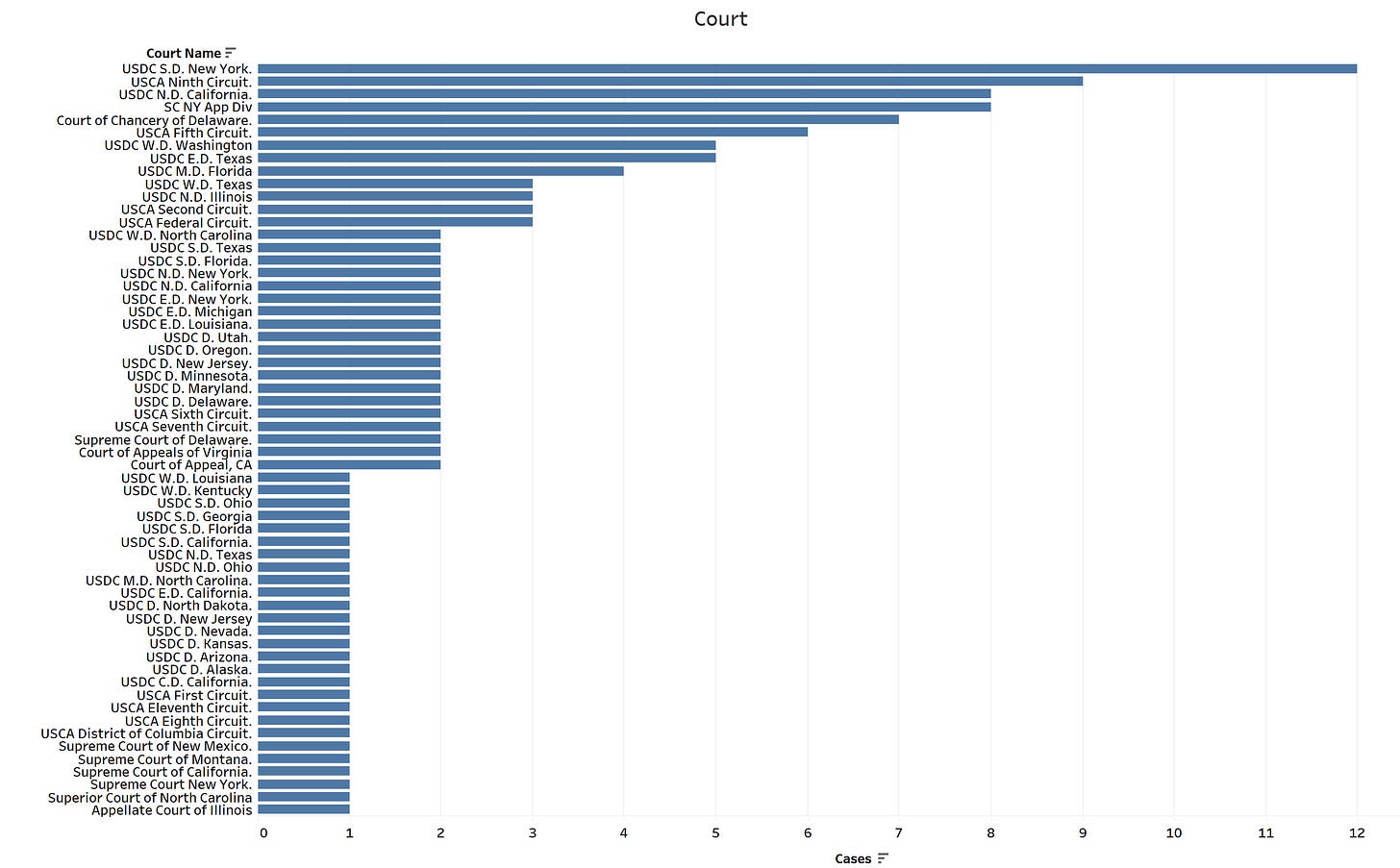

To get a sense of the lay of the land, below are the courts that issued these opinions.

Here we see the impact of the coasts as the four courts with the most decisions are SDNY (New York), NDCA (California), the Ninth Circuit Court of Appeals (west coast), and the appellate divisions of the New York Supreme Court (the intermediate appeals tribunal in New York).

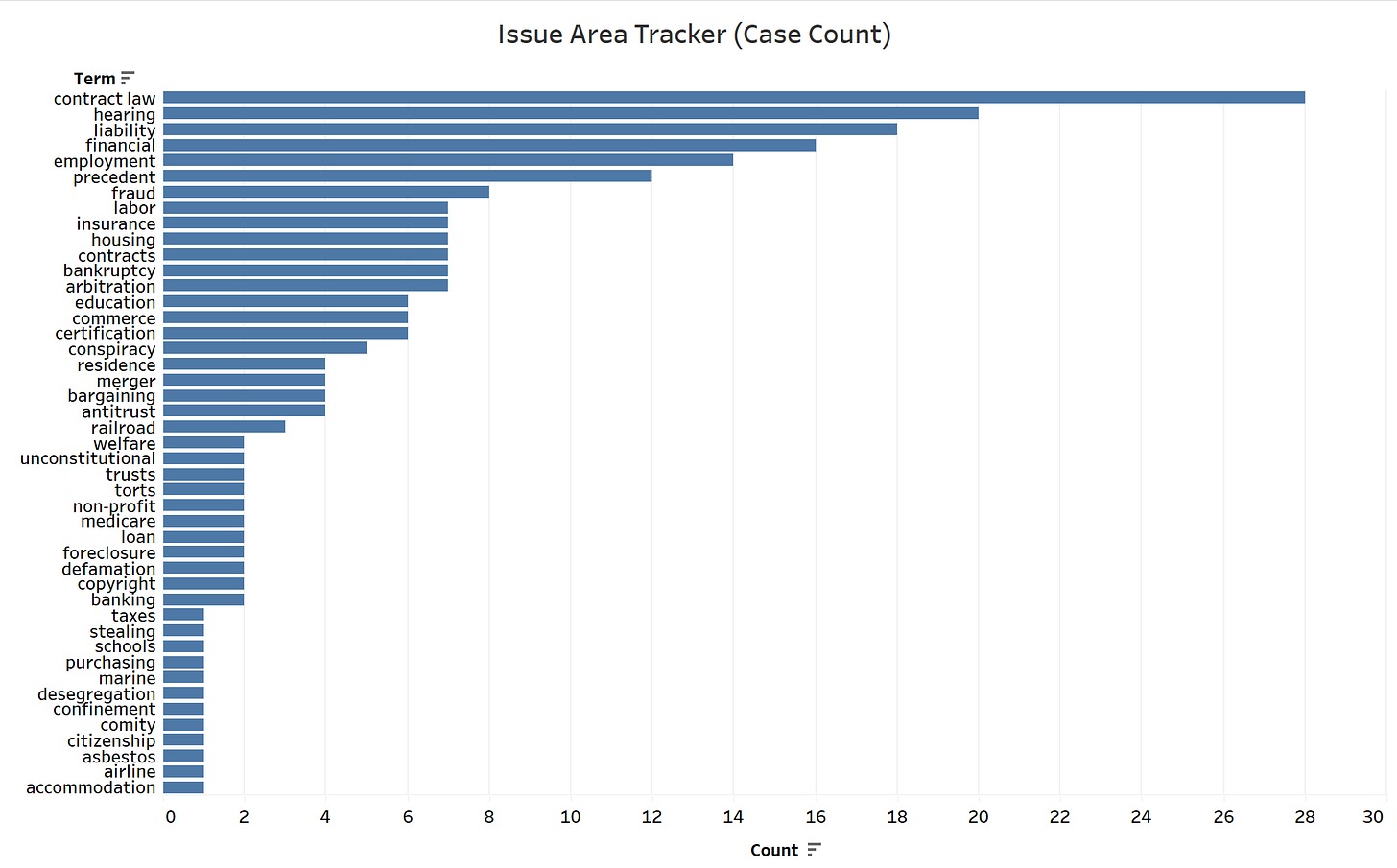

Next is a quick way to break down some of the significant issues in the cases based on a dictionary approach looking for multiple times these terms arise in a decision.

Many of these cases (perhaps not surprisingly for big firms) deal with financial implications and deals that broke down. There are still a nontrivial number of cases where the immediate concerns are not financial or at least are not predicated only on business interests.

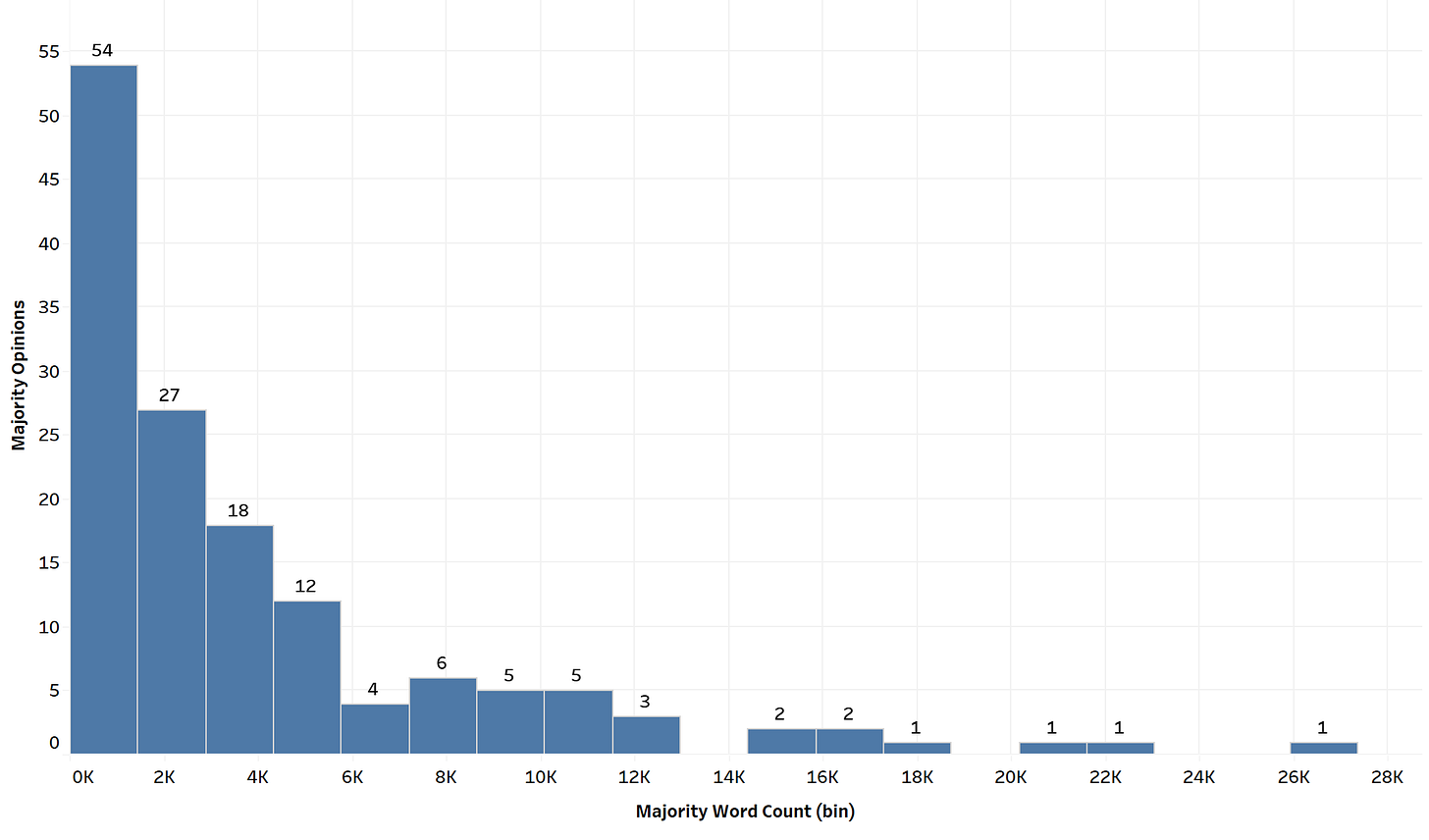

Lastly a look at opinion count based on a distribution of majority word counts.

Most of these opinions are fairly short although only six were excluded from the analyses due to fewer than 100 words in them.

I ordered this list of five cases based on relative importance, mainly on dispersed impact, but also based on the other factors I described above.

Case 1) Alliance for Fair Board Recruitment v. SEC (CA5)

Court: United States Court of Appeals, Fifth Circuit

Decision Date: December 11, 2024

Majority Opinion: Oldham; Dissent: Higginson

Issue Areas: {housing, financial, commerce, employment, liability, fraud, contracts}

Majority words count: 11,351; Dissent word count: 2,460

Amicus briefs: 14

What it’s about: This case centers around a legal challenge to rules set by the Securities and Exchange Commission (SEC) and Nasdaq regarding the disclosure of certain demographic information about directors of public companies. Specifically, the rules required companies listed on Nasdaq to disclose data about the race, gender, and sexual characteristics of their directors. The plaintiffs AFBR, argued that these disclosure requirements went beyond what is allowed under the law and violated certain legal principles.

At its core, this case is about whether government regulators, like the SEC and Nasdaq, can require companies to disclose sensitive information about their directors for the purpose of promoting transparency, even if such disclosures aren’t directly related to financial performance or investor protection.

The Positions of the Two Sides:

AFBR (Petitioner):

AFBR, a group representing certain companies affected by the Nasdaq rule, argues that the SEC and Nasdaq have overstepped their authority by mandating disclosures of information that are not required by law. The main claim is that these rules go against the intent of the securities laws, which were created to protect investors from fraud, manipulation, and speculation, not to mandate social or demographic disclosures.

The group argued that requiring such disclosures doesn’t align with the goals of the Securities Exchange Act, which was primarily designed to prevent financial fraud and market manipulation, not to force companies to reveal demographic information unrelated to financial performance.

SEC and Nasdaq (Respondent):

The SEC and Nasdaq argue that their rules are within their authority and are in line with the objectives of the Securities Exchange Act. They believe that forcing companies to disclose such information is beneficial for investors and markets because it improves transparency and could potentially enhance corporate governance.

They argued that the rules are related to the Exchange Act’s goals of providing transparency and protecting investors, and that disclosing demographic data about company directors might help investors make better-informed decisions about the companies they invest in.

Key Legal and Policy Issues:

Jurisdiction and Standing: One threshold issue in the decision was determining if AFBR had the right to challenge the rule in court. Since AFBR represented companies that were affected by Nasdaq’s rules, they had the legal standing to bring this case.

Authority and Scope of the SEC and Nasdaq: The main legal issue was whether the SEC and Nasdaq had the authority to require companies to disclose personal demographic information about their directors. AFBR argued that this wasn’t within the scope of the securities laws, while the SEC and Nasdaq argued that the rules were related to their duties to ensure transparency in the market.

In this decision, the major questions doctrine (a current hot topic) plays a central role in limiting the scope of the SECs regulatory power over corporate governance, particularly regarding the imposition of diversity requirements on corporate boards.

Major Questions Doctrine:

The doctrine asserts that when an administrative agency, like the SEC, seeks to exercise power over a matter of significant economic or political importance, it must have clear and explicit authorization from Congress. This is because such power, if implied or unclear, could lead to significant changes in the nations economic landscape or government structure without proper democratic oversight. In this case, the SEC’s attempt to impose diversity requirements on corporate boards is seen as a "major question" due to its massive economic and political implications. In this case, The SECs action of requiring Nasdaq-listed companies to adopt board diversity policies is characterized as a "major question" because it affects the internal structures of large corporations, including those with a combined market value greater than the GDP of the United States. The court argues that, while the SEC has broad powers under the Exchange Act, it cannot claim authority to reshape corporate governance based on vague statutory provisions without clear congressional approval.

The court also highlights that this kind of regulation—pertaining to diversity on corporate boards—is traditionally handled by other agencies (like the Equal Employment Opportunity Commission) or state laws, not the SEC. Therefore, applying the major questions doctrine here requires skepticism of the SEC’s action, as no clear congressional mandate for such regulation exists in the Exchange Act.

Holding: Ultimately, the court concluded that the SEC’s power to regulate corporate governance did not extend to imposing diversity requirements on corporate boards, as such a measure lacks the clear congressional authorization required by the major questions doctrine.

Main points in the dissent:

Nasdaq’s Role and SECs Limited Authority: Nasdaq, as a private company, proposed a rule (the "Disclosure Rule") requiring companies to disclose their board diversity. The dissent argues that the SEC’s role is limited and that it is not authorized to override Nasdaq’s judgment unless the rule violates the Exchange Acts requirements. The SEC’s approval of the rule aligns with the purpose of encouraging market efficiency and investor transparency.

Investor Demand for Diversity Information: The dissent highlights that there is substantial evidence showing that investors sought information about board composition, despite inefficiencies in how such data was previously reported. Nasdaq responded to this demand with a rule that standardizes board diversity disclosures, aiming to address information asymmetries between large and small investors.

Disclosure vs. Quota: The dissent emphasizes that the Disclosure Rule is focused on providing information, not imposing a quota system for board diversity. This aligns with SEC’s finding that the rule is designed to remove barriers to market efficiency rather than mandate hiring practices.

Private Experimentation and Limited SEC Intervention: The dissent defends the concept of self-regulation by exchanges like Nasdaq, which can refine their rules based on market demands. The SEC’s review should be limited to ensuring the rule doesn’t violate the principles of the Exchange Act, rather than imposing its own policy preferences.

Consistency with Existing Regulatory Practices: The dissent notes that Nasdaq’s rule aligns with existing disclosure requirements, such as those enforced by the EEOC and SEC, demonstrating consistency with broader regulatory practices.

Case 2) Cross v. Montana (MT S. Ct.)

Court: Supreme Court of Montana

Decision Date: December 11, 2024

Opinion Author: Justice Baker; Concurrence: Justice McKinnon; Concurrence and Dissent: Justice Rice

Areas of Law {employment, hearing, insurance, unconstitutional, evidence}

Majority word count: 8,211; Concurrence (McKinnon): 1,579; Concurrence and Dissent in part (Rice): 661

Amicus Briefs: 2

What it’s about: This case addresses the constitutionality of Montana Senate Bill 99 (SB 99), a law enacted in 2023 that restricts specific medical treatments for minors diagnosed with gender dysphoria. The Plaintiffs argued that the law violates Montana's constitutional rights, including privacy and equal protection. Here's a summary of the key issues:

Overview of SB 99

Purpose: The law aims to protect minors from undergoing “harmful, experimental” treatments such as puberty blockers, cross-sex hormones, and certain surgical procedures before they reach adulthood.

Prohibitions:

The law prohibits the administration of puberty blockers and hormones (e.g., testosterone for female minors, estrogen for male minors) intended to affirm a minor's gender identity.

Bans specific surgeries (e.g., hysterectomy, vaginoplasty) performed to affirm a gender identity incongruent with a minor's sex assigned at birth.

Exemptions: These procedures and treatments are permitted if they are not aimed at addressing a minor's perception of their gender identity.

Professional Penalties: Health professionals who violate the law face disciplinary actions, including suspension of their license for at least one year, civil liability, and exclusion of insurance coverage for damages.

Plaintiffs' Arguments

Constitutional Violations: SB 99 infringes on privacy and equal protection rights guaranteed under Montana's Constitution.

Medical Necessity:

Treatments banned under SB 99 are supported by medical standards (e.g., WPATH Standards of Care Version 8) and are often necessary for addressing gender dysphoria.

Evidence submitted indicates untreated gender dysphoria can result in severe mental health issues, including depression and suicidality.

Expert Testimony: Plaintiffs' experts attest that gender-affirming care is safe, effective, and the accepted standard of care for minors with gender dysphoria.

State's Defense

Medical Concerns:

The State argues that there is no consensus within the medical community on using puberty blockers and hormones for minors with gender dysphoria.

It asserts that gender-affirming care may harm minors.

Legislative Authority: SB 99 reflects the State's interest in regulating medical practices to protect minors.

Holding: The court decided to uphold the District Court's preliminary injunction against SB 99, finding that the plaintiffs had shown a likelihood of success on the merits of their privacy claim. The District Court determined that SB 99, which bans certain medical treatments for minors, violated the plaintiffs’ fundamental right to privacy under the Montana Constitution. The court applied strict scrutiny and found that the State had not demonstrated a compelling interest or that the law was narrowly tailored to achieve such an interest.

Key aspects of the decision include:

Prima Facie Case Against SB 99: The District Court concluded that the plaintiffs presented sufficient evidence to establish that the treatments banned by SB 99 are not harmful or experimental, and therefore, do not justify the State’s interference under the Armstrong standard.

Strict Scrutiny Standard: The statute's impact on individual privacy rights triggered strict scrutiny, requiring the State to justify the law with a compelling interest and show that it was narrowly tailored. The State's failure to demonstrate that the banned treatments posed a bona fide health risk meant it could not meet this standard.

Preliminary Injunction Process: The court rejected the State’s argument that the District Court erred by not allowing live testimony or cross-examination during the preliminary injunction hearing. It found that the District Court had broad discretion in how it conducted the hearing and provided both parties a full opportunity to submit evidence.

Irreparable Harm: The court agreed that the plaintiffs faced irreparable harm absent the injunction because the statutory restrictions prevented individualized medical care for minors, affecting their fundamental rights.

Overall, the court emphasized that the preliminary injunction did not resolve the ultimate merits of the case, which would be determined at trial. However, it found no abuse of discretion in the District Court’s decision to enjoin SB 99 pending a final determination.

Justice McKinnon: Justice McKinnon concurred with the Court's decision to uphold the preliminary injunction on the plaintiffs’ right to privacy claim but emphasized the importance of addressing the equal protection claim as well. McKinnon highlighted that Montana's constitutional protections are broader than their federal counterparts, particularly in prohibiting discrimination on the basis of sex, which includes transgender status. McKinnon criticized the Court’s avoidance of this issue, arguing that it leaves litigants and lower courts without crucial guidance, fosters uncertainty, and delays justice for those impacted by SB 99. McKinnon underscored the necessity of recognizing transgender persons as a suspect class and applying strict scrutiny to the law, asserting that this case presents an opportunity to provide clarity on these critical legal questions under Montana's Constitution.

Justice Rice: Justice Rice concurred with upholding the preliminary injunction, agreeing that SB 99's restrictions fail to meet the high bar of addressing a bona fide health risk but noted that evolving medical and legal standards require ongoing evaluation.

Case 3) In Re Mindbody (DE S. Ct.)

Court: Supreme Court of Delaware

Decision Date: December 2, 2024

Opinion Author: Justice Valihura

Areas of law {conspiracy, merger, bargaining, contract law, financial, torts, purchasing, liability, fraud}

Opinion word count: 26,435

Amicus brief: 0

What it’s about: This case revolves around the sale of Mindbody, a software company, to Vista Equity Partners for $36.50 per share in 2018. The lawsuit focuses on whether the company's CEO, Rick Stollmeyer, and the board of directors acted properly during the sale process. Shareholders claim that Stollmeyer prioritized his own interests over securing the best price for investors, including early discussions with Vista, favoring them over other bidders, and failing to disclose critical financial information before the merger vote. The case examines whether these actions violated fiduciary duties to shareholders and influenced the sale’s outcome unfairly.

Decision: CEO Richard Stollmeyer, Vista Equity Partners Management, LLC, and Mindbody lost on several critical points, including:

Breach of Fiduciary Duty: The Court found that Stollmeyer breached his fiduciary duty of loyalty by failing to maximize the company’s sale price for stockholders.

Failure to Ensure an Informed Stockholder Vote: The stockholder vote approving the merger was found to be insufficiently informed.

Material Omission in Proxy Statement: The acquirors failure to include important information regarding their informational advantages was considered material.

Stollmeyer and the acquirer were also found to have waived their right to seek settlement credit and the acquirers failure to correct material omissions did not meet the "knowing participation" element for aiding and abetting claims.

What the appellants won:

The Delaware Supreme Court reversed certain aspects of the trial court’s ruling, particularly concerning the acquirors responsibility for aiding and abetting the CEOs breach of duty.

The Delaware Supreme Court held that the acquirors failure to correct the proxy statement did not fulfill the "knowing participation" standard needed for the aiding and abetting claim. Additionally, the Court found that the acquirors contractual duty did not create an independent fiduciary duty of disclosure to the stockholders.

The appellees (stockholders) were the bigger winners, as they secured the damages award and the ruling on the breach of fiduciary duty. The appellants (CEO and acquiror) managed to secure partial reversals, particularly on the aiding and abetting claims.

Case 4) Bobnar v. AstraZeneca (NDOH)

Court: N.D. Ohio,

Decision Date: November 26, 2024

Opinion Author: Judge Pamela Barker

Areas of Law {contract law, employment, liability, accommodations, precedent, religion, labor, evidence}

Opinion Word Count: 21,711

Amicus Briefs: 0

What it’s about: This case centers around an employee, Bobnar who worked AstraZeneca, a pharmaceutical company, and requested religious exemptions from the company’s COVID-19 vaccine mandate. Bobnar requested a religious accommodation to avoid the COVID-19 vaccine, citing his religious beliefs about bodily integrity. However, his request was denied, and he was eventually terminated by AstraZeneca.

Bobnar also applied for paternity leave under the Family and Medical Leave Act (FMLA), which was granted. However, he faced issues during his leave, including being contacted by coworkers for work-related matters and feeling pressured to continue business activities while on leave. He considered these communications harassment. Bobnar was also part of a sales incentive program and was expecting a bonus, but his termination affected his eligibility to receive the bonus.

The legal issues in the case revolve around whether AstraZeneca appropriately handled the religious accommodation requests and whether Bobnar’s termination was justified, particularly in relation to his leave and bonus eligibility. The case also touches on the legality of AstraZeneca’s actions under employment law, including how they managed the accommodation requests, leave, and incentive pay.

Decision Parts:

Title VII Religious Discrimination/Failure to Accommodate (Count One): The Court found that AstraZeneca discriminated against Bobnar by denying his request for a religious accommodation related to a vaccine mandate. The Court ruled that Bobnar’s termination was discriminatory and granted summary judgment in Bobnar’s favor on this count.

FMLA Interference and Retaliation (Count Four): The Court found that AstraZeneca did not interfere with Bobnar’s FMLA leave, as he voluntarily performed some work during his leave. The Court also ruled that there was no retaliation for taking FMLA leave, granting summary judgment in favor of AstraZeneca on this claim.

Breach of Contract (Count Five): The Court ruled that AstraZeneca wrongfully denied Bobnar his earned bonus for Q1 2022, as his termination was unlawful. The Court granted summary judgment in Bobnar’s favor on the breach of contract claim, stating that AstraZeneca was required to pay him the bonus.

Violation of Ohio’s Prompt Pay Act (OPPA) (Count Six): AstraZeneca’s motion for summary judgment was granted on this claim because there was a dispute over whether Bobnar was entitled to the bonus, and the OPPA does not apply where a dispute exists regarding the payment of wages.

Why was Bobnar the bigger winner?

Key Wins: Bobnar succeeded on the two claims that were central to his legal battle—religious discrimination under Title VII and the breach of contract regarding the unpaid bonus.

Damages and Compensation: The breach of contract ruling, in particular, could result in Bobnar receiving the bonus he earned, which is a significant financial win.

Religious Discrimination: The courts ruling on the Title VII claim implies that AstraZeneca could face significant legal and financial repercussions for discriminating against Bobnar based on his religious beliefs.

In contrast, the claims that AstraZeneca successfully defended against (retaliation under Title VII, FMLA claims, and OPPA violation) were either appear less financially impactful in comparison to the two claims Bobnar won.

Case 5) Fausett v. Walgreen (IL Ct. App.)

Court: Appellate Court of Illinois, Second District

Areas of Law {insurance, commerce, education, liability, fraud}

Majority: Justice Mullen; Dissent: Justice McLaren

Majority word count: 10,953; Dissent word count: 698

Amicus brief: 1

What it’s about: This case centers on a claim brought by plaintiff Calley Fausett against Walgreen Company (doing business as Walgreens), alleging that Walgreens violated the Fair and Accurate Credit Transactions Act of 2003 (FACTA). Specifically, the plaintiff claims that Walgreens printed more than the last five digits of debit card numbers on receipts provided to customers, which is prohibited under section 1681c(g)(1) of FACTA.

Positions of the Parties:

Plaintiff (Calley Fausett): Fausett argued that Walgreens willfully violated FACTA by printing too many digits of her debit card number on receipts, which exposed her to an increased risk of identity theft. She asserts that this violation is sufficient to bring a claim, even though she did not suffer any actual injury or financial loss. Fausett sought statutory damages, punitive damages, and attorneys fees, and moved for class certification to represent others affected by the same issue.

Defendant (Walgreens): Walgreens contended that the claim was not actionable because Fausett had not demonstrated any actual injury. They argued that revealing part of a debit card number did not pose a significant risk of harm, and thus Fausett lacked standing to sue under Illinois law. Walgreens also challenged the appropriateness of class certification, asserting that the violation did not support class-wide claims.

Legal Background:

FACTAs Truncation Requirement: The law prohibits businesses from printing more than the last five digits of a debit or credit card number on receipts to protect consumers from identity theft.

Standing: Walgreens argued that, under federal law, a plaintiff must show concrete harm to have standing. However, Illinois courts had taken a more liberal approach to standing, allowing claims for statutory violations even in the absence of actual injury.

Court’s Decision: The court ruled in favor of the plaintiff, affirming the decision of the circuit court to grant class certification. The court concluded that the plaintiff had standing to bring a claim under FACTA in Illinois state court. The court rejected the defendants argument that the plaintiff lacked standing due to the absence of an actual injury, stating that under Illinois law, a violation of statutory rights, such as a willful violation of FACTA, is sufficient to confer standing. This conclusion was consistent with Illinois approach to standing, which does not require proof of concrete harm or injury in fact. The court emphasized that it was not addressing the ultimate success of the plaintiffs claim, only the issue of standing and the propriety of granting class certification.

Dissent: Judge McLaren disagreed with the majority’s decision to approve the class certification (the ability of the plaintiff to represent a group of people in the lawsuit) at this stage. The dissent argued that the majority made an incomplete and speculative decision by addressing only one issue—whether the plaintiff has standing to bring the case—while ignoring other important legal questions, such as whether the plaintiffs claim is valid or whether certain legal defenses apply. The dissent also criticized the majority for affirming the class certification without fully reviewing all the necessary details, which the dissent believed should have been handled by the trial court before deciding on the class. Essentially, the dissent argued the majority was making a premature decision without enough information and should have sent the case back for further review instead of addressing the class certification.

Stay tuned. More to come later in the week.